Forex Chart Patterns

Mastering Trading Patterns: A Path to Consistent Profits

Introduction:

Trading in the financial markets is a dynamic and often unpredictable endeavor. Yet, experienced traders will tell you that amidst the chaos, certain patterns emerge time and time again. These patterns, like familiar road signs on a winding journey, can guide traders to profitable destinations. In this article, we'll explore the world of trading patterns, offering insights into their significance, and how mastering them can be the key to achieving consistent profits.

1. The Head and Shoulders Pattern:

Imagine looking at a price chart and spotting a pattern that resembles a head with two shoulders. This is precisely what the Head and Shoulders pattern looks like, and it's a powerful tool in the trader's toolkit. It signifies a potential reversal in the prevailing trend. Here's how it works:

Shoulder 1:

This is the left shoulder, where the price reaches a peak before dipping.

Head:

The head is the highest point, followed by a more substantial price drop.

Shoulder 2:

This is the right shoulder, forming another peak but generally lower than the head. The pattern confirms when the price drops below the "neckline."

When this pattern appears after an uptrend, it's a signal that a reversal to a downtrend might be on the horizon.

2. The Double Bottom Pattern:

A double bottom pattern looks like the letter "W" on a price chart. It's a bullish reversal pattern that suggests an end to a downtrend. Here's how it unfolds:

First Bottom:

After a downtrend, the price forms a low point and then rebounds.

Second Bottom: A subsequent drop in price occurs, creating another low point that is often close to the first one.

Breakout:

The pattern is confirmed when the price rises above the "neckline," which is the high point between the two bottoms.

This pattern is a strong indication that a new uptrend may be underway.

3. The Bullish Engulfing Pattern:

The Bullish Engulfing pattern is a simple yet powerful signal of a potential upward price reversal. It happens when a smaller bearish candle is followed by a larger bullish candle that "engulfs" the previous one. This suggests a shift from bearish sentiment to bullish sentiment.

Conclusion:

Trading patterns are like the footprints left by market sentiment, and they offer valuable insights to those who can read them. However, it's essential to remember that patterns are not foolproof and should always be used in conjunction with other forms of analysis and risk management.

Mastering these patterns takes time and practice, but the rewards can be substantial. Consistency in trading profits often stems from the ability to recognize these patterns and use them as part of a broader trading strategy. So, whether you're a novice or a seasoned trader, studying and understanding trading patterns can be your guiding light in the complex world of financial markets.

SYMMETRICAL TRIANGLE- CONTINUATION - BULLISH VARIANT

FLAG (CONTINUATION - BEARISH VARIANT

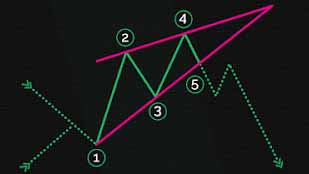

PENNANT (CONTINUATION - BULLISH VARIANT)

DOUBLE TOP (REVERSAL - BEARISH ONLY)

TRIPLE TOP (REVERSAL BEARISH ONLY)

TRIPLE BOTTOM (REVERSAL - BULLISH ONLY)

DOUBLE BOTTOM (REVERSAL - BULLISH ONLY)

PENNANT (CONTINUATION - BULLISH VARIANT)

FLAG (CONTINUATION BULLISH VARIANT)

RECTANGLE (CONTINUATION - BULLISH VARIANT)

RISING WEDGE (NEUTRAL - BEARISH ONLY)

INVERSE CUP AND HANDLE (CONTINUATION - BEARISH ONLY)

HEAD AND SHOULDERS (REVERSAL BEARISH ONLY)

DESCENDING TRIANGLE (CONTINUATION - BEARISH ONLY)

SYMMETRICAL TRIANGLE (CONTINUATION - BEARISH VARIANT)

FALLING WEDGE (NEUTRAL - BULLISH ONLY)

CUP AND HANDLE (CONTINUATION - BULLISH ONLY)

INVERSE HEAD AND SHOULDERS (REVERSAL - BULLISH ONLY)

ASCENDING TRIANGLE (CONTINUATION - BULLISH ONLY)

SYMMETRICAL TRIANGLE- CONTINUATION - BULLISH VARIANT